I have noticed the general public have no clue what is happening behind the curtains in the economy, this is unprecedented times; most investors still fail to appreciate what's really happening here. I think at this moment it is critical to see the truth and position yourself and your family for the oncoming train wreck about to happen.

The smart money the likes of George Soros, John Paulson and countries such as India and China are buying gold. Not only has the US have been printing fiat money, Europe and other countries are printing trillions of dollars like it's going out of fashion. If you think the U.S. is immune to all this, you're wrong. Just because the U.S. has the world's reserve currency and has the deepest and most liquid financial markets does NOT mean it can continue to write blank checks to finance its bloated spending.

The CBO (Congressional Budget Office) estimates the US budget deficit will hit a record $1.6 trillion dollars in the year ending September 30 and total $5.1 trillion over the next five years. The $1.4 trillion dollar deficit in 2009 was equal to 9.9% of GDP - the largest share of the economy since the end of WWII.

The U.S. won't be able to sell enough bonds to foreign investors to finance this ever-growing debt. More likely they will continue money printing. This is the only way they know to secure capital whenever the Treasury can't sell bonds to foreigners. This will cause Interest rates to rise, bond markets will crash and inflation will surge.

Europe is now suffering from its own version of subprime as economies start to fall like dominos. Just recently, German, France and the IMF (International Monetary Fund) have agreed to bail out Greece and inject $1 trillion USD into the Eurozone to stem the crisis from escalating. Greece will eventually be joined by Spain, Portugal and Italy as the debt cancer spreads. The credit crisis has entered a new phase as sovereign debt markets grow increasingly unstable.

The develop countries are sick with the debt cancer, the governments around the world are desperately throwing money to keep the patient alive, not solving the real core issue. Even after all the bailouts, these debtor nations are all still looking to secure financing. But every day, the deflationary noose tightens just a bit more. Iceland and Dubai are just small examples of what lies ahead if governments fail to reduce spending and control their finances

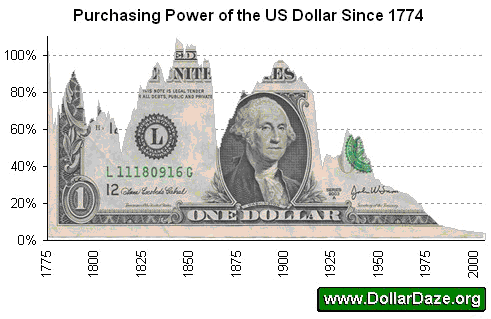

The Government will not allow anyone to fail; they will keep bailing out companies and countries at the expense of the tax payers. Government will do what is least painful in the short term, remember they want to be elected again for the next term. They will solve this problem by cranking the printing press and print more, devaluing their currencies hoping the global economy to grow artificially. That's bad news. Currency devaluation reduces purchasing power and produce long-term inflation.

Gold prices are rising because the smart money knows that high levels of government debt can't last forever

Major central banks in the United States, Europe and Japan will not raise interest rates fast enough. They simply can't when consumers aren't buying and unemployment is still high.

That's why I believe all these central bank mistakes will feed gold's already high price for the foreseeable future.

I invite you to visit http://www.gambitrader.com there is a ton of educational information mainly based on the financial markets that will help you in your quest for knowledge.

Bruce Nunez from Gambitrader

Article Source: http://EzineArticles.com/?expert=Bruce_Nunez

No comments:

Post a Comment